[ad_1]

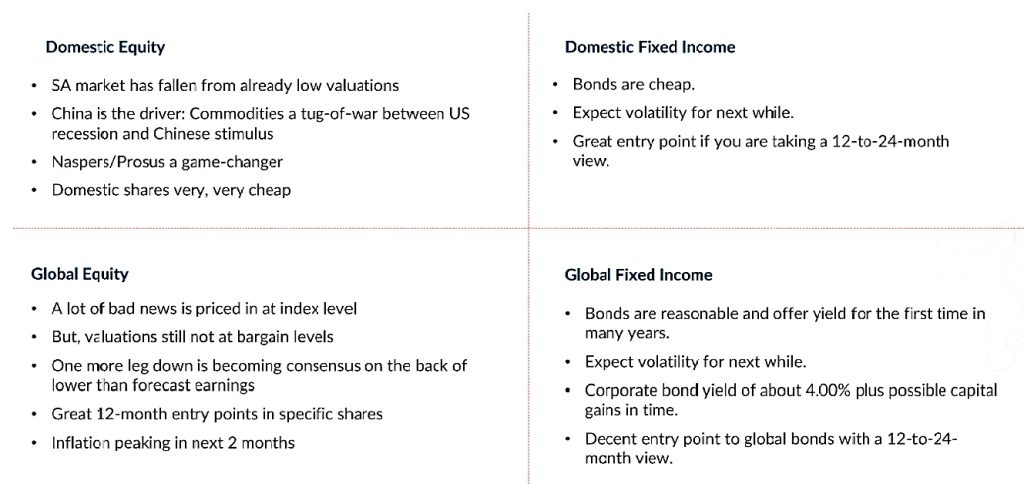

An financial investment in neighborhood shares and bonds is certain to produce the greatest returns more than the subsequent 12 to 24 months, although intercontinental equities and international bonds will most likely lag the returns the regional bourse and bond sector guarantee.

Anchor Capital CEO and co-main investment officer Peter Armitage instructed buyers in just one of firm’s regular updates on the investment potential of diverse asset courses, that they can anticipate the the latest volatility in fairness and bond marketplaces to go on for the rapid long run – but that possibilities abound.

“The chance is that great outcomes are feasible if it is not as undesirable as the environment is chatting,” he says, referring to the seemingly around the globe wave of negativity that has frustrated economic marketplaces to deal concentrations.

“If you appear as a result of the past little bit of feasible draw back, the upward trajectory in 12 months’ time is wonderful.”

Asset supervisor Anchor’s investigation into where by traders can come across the ideal benefit now and wherever to search for the most effective returns more than the next few months located that shares of regional companies are very likely to outperform those people of global businesses, simply due to the fact regional shares are on lessen scores than overseas equities. This is specifically legitimate with regards to people ever-well-known US technology stocks.

Domestic equities are envisioned to give a return of all-around 15%, local bonds just more than 10% and dollars only 5%.

World-wide equities will return only 10%, government bonds 3%, international corporate bonds 4.5% and money invested offshore a extremely lower 1.5%, according to Anchor.

Bargains

Armitage claims the SA equity current market has fallen from currently lower valuations, pointing out that the surges in the charges of Naspers and Prosus ended up the only visible contributors to returns in the next quarter of 2022.

He describes the the latest bulletins by Naspers and Prosus about the sale of Tencent shares and applying the proceeds to obtain back again Naspers and Prosus shares as “a video game changer”.

When Anchor calculated the numbers for its analysis, Naspers was buying and selling at a price reduction of more than 50% to the worth of its underlying investments, mostly its financial commitment in Tencent.

“Naspers can provide an asset for R100 and acquire it back again on the exact working day for R50,” suggests Armitage.

Anchor calculates that this could increase far more than 10% to its net asset price (NAV) each individual year.

The same goes for Prosus, though the win is not as pronounced, given that recent share price motion has lessened the discount to NAV for Prosus to around 41%.

So, even following the sharp soar in Naspers and Prosus, area shares are low cost.

“Domestic shares are very, incredibly low cost,” says Armitage, noting that bank shares are buying and selling at attractive prices and that a very likely restoration in commodity markets could boost source stocks.

Anchor expects that banking shares will return all over 15% above the upcoming year, though commodity shares could supply returns in surplus of 30%.

Armitage states current share rates of main banking companies are reminiscent of a “fire sale”, pointing out that the banks attained significant returns on fairness and could continue on to expand earnings strongly – but various shares are sitting on lower selling price-earnings ratios of 6 to seven occasions, and at the best dividend yields found in numerous a long time.

SA bonds

Anchor’s head of fastened profits and co-main financial investment officer Nolan Wapenaar says SA governing administration bonds offer you price much too.

“Current amounts depict a good entry stage if you are having a 12- to 24-thirty day period watch,” says Wapenaar, even though he warns that traders must anticipate volatility to go on in excess of the next number of months, as financial investment sentiment is certain to adjust offered the present unsure financial natural environment.

He details out that yields on authorities bonds are at elevated stages as buyers feel to be factoring in the worst – the R2030 is at the moment investing at earlier mentioned 11%, the best in many years besides for the shorter spurt in March 2020 when government announced stringent Covid-19 lockdown measures.

SA bond sector demonstrates worst-situation circumstance

Source: Anchor Money

International equities

In distinction, Anchor arrives to the summary that global equities are continue to a bit on the highly-priced aspect, when world wide bonds provide minor worth too.

In the course of a presentation of the analysis benefits, Armitage put up graphs of a number of of the well-known US shares to display the audience that some of these shares have declined sharply as they re-rated from formerly incredibly large scores to additional reasonable valuations, but that ratings still appear fairly demanding.

Major tech shares like Apple, Alphabet and Microsoft fell back to pre-Covid-19 amounts after the robust growth when investor anticipations surged on ‘work, study and entertain at home’ being seen as the ultimate alternative to the world’s issues.

Inspite of the relatively big declines, Anchor’s worldwide fairness analyst James Bennett says global information technological innovation shares are not in “deep value territory” – but that buyers really should not avoid the sector entirely.

“Some tech corporations have shown a outstanding means to develop into what seemed like stretched valuations at the time,” he states, hinting that the recent decrease rankings won’t previous for good.

Study: Nasdaq win streak is fueled by tech losers turning into winners

“Tech proceeds to have a location within just a well balanced portfolio,” says Bennett.

“Tech investing is increasingly mission-significant for companies to develop their earnings. The productive application of modern-day know-how is enabling firms to scale much quicker than in traditional brick-and-mortar corporations.

“We think that it would be a oversight to avoid the sector as a complete,” he provides.

“These styles of promote-offs normally create great buying alternatives in specific shares and the present-day pull-again is not likely to be any various in this regard.”

Get ready for volatility

Anchor warns that investors need to be well prepared for risky markets.

“Outside of the pitfalls we flag on a weekly foundation impacting the South African financial state – these types of as substantial unemployment, Eskom, and corruption – the pressing hazard for the JSE and portfolio building is the inherent dependence of the global commodity cycle keeping up,” suggests Armitage.

“The JSE is seriously dependent on the mining exports. Should we see a deterioration of vital export commodities, it wouldn’t only impact our evaluation of individuals corporations with immediate publicity, but also impact on the currency and inwardly-centered sectors like banking institutions, insurance policies, retail and basic industrials.”

Overview of financial commitment solutions

Source: Anchor Capital/Thomson Reuters

[ad_2]

Supply url