[ad_1]

Even though leases generally comprise a important piece of a business’ finances, most businesses do not know how much their leases value and quite a few are unsure about how to account for them underneath the new rules.

Just about three-quarters (71%) of personal corporations are not fully self-confident they know how a great deal their leases expense their business, according to a examine introduced Monday by the Visible Lease Institute. That deficiency of recognition and visibility is 1 of the key motives why companies are sluggish to transition to the new lease accounting normal from the Financial Accounting Requirements Board recognized as ASC 842. One-third (33%) of private organizations still aren’t totally organized to transition to ASC 842, which has taken influence for 2022 and 2023 monetary statements, in accordance to the review, which surveyed 200 senior finance and accounting gurus. Public corporations experienced to make the transition in 2019 to the new regular, which places running leases on the equilibrium sheet of many providers for the initially time.

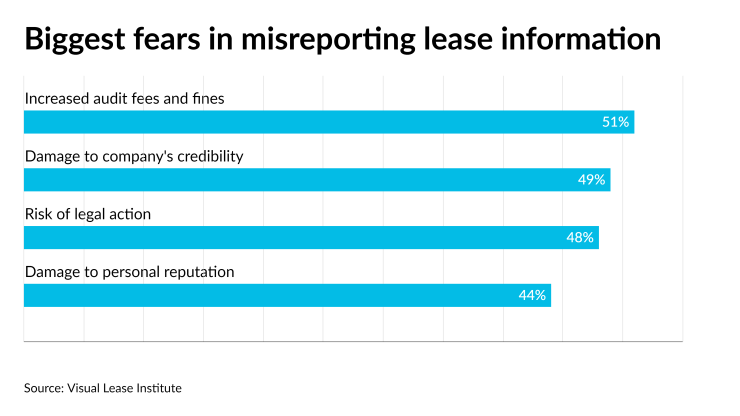

Executives are also worried about making faults, with 99% of the senior finance and accounting industry experts surveyed at non-public businesses acknowledging fears about most likely misreporting firm lease facts. Their concerns incorporate increased audit costs and fines (51%), destruction to a company’s credibility (49%), the threat of legal action (48%) and harm to their personal particular standing (44%).

The Governmental Accounting Standards Board has also unveiled its own current leases regular, GASB 87, for state and neighborhood governments. Its helpful date was delayed until June 15, 2021, due to the pandemic. Even however it has technically taken effect, the examine located a hold off seems to be rising in implementation of the regular. Forty-four per cent of the governing administration industry is not thoroughly ready to transition to GASB 87 and only 18% of authorities establishments are at a level wherever they are thinking about lease accounting routine maintenance beyond first compliance. In addition, almost just one-fourth of govt entities aren’t mindful of an additional impending GASB conventional, GASB 96, which will affect how governmental businesses report on their subscription-primarily based information technology agreements for fiscal a long time commencing soon after June 15, 2022.

“For yrs, corporations may possibly have been able to get absent with loosely controlling and tracking their leases, but that is no more time the case with new lease accounting expectations, which involve leased assets to be reflected on the balance sheet,” reported Visible Lease CEO Marc Betesh in a statement. “In addition to these new benchmarks, the international financial climate is producing extra worries all over employing correct inner controls and lease management processes.”

Apart from the pandemic, workforce shortages and retention difficulties have been triggering private organizations and federal government entities to delay their changeover to the new criteria. A disproportionate 93% vast majority of private businesses and 86% of govt organizations say their teams are previously stretched thin, making lease accounting even a lot more frustrating. Meanwhile, almost 40% of personal corporations noted that avoiding personnel burnout is a best problem associated with sustaining right regulate over their lease portfolio.

Calling in the accountants

Some accounting companies have been listening to extra issues recently from their consumers about the standard. “We are absolutely observing an uptick in the amount of queries coming in from our consumers,” mentioned Heather Winiarski, a shareholder at Major 100 Company Mayer Hoffman McCann Pc, in Kansas Town, Missouri. “A whole lot of customers are starting up to really get into the facts, inquiring about the new leasing normal and looking at employing software program to help. It is certainly gotten a ton busier in the very last couple months.”

Among the challenges for clientele is figuring out all the contracts that could be considered leases underneath the new standard. “A good deal of the worries that they’re facing is making an attempt to make absolutely sure that they are identifying all of the contracts that may possibly be leases, finding the complete listing of the population, and then after they’ve discovered that inhabitants, figuring out the price reduction level that demands to be utilised to do the accounting,” mentioned Winiarski. “There is a practical expedient to permit lessees to use a risk-absolutely free level, so organizations are evaluating if they’re going to use that or if they’re heading to figure out the incremental borrowing price for their leases. There is a dialogue all-around that, and then assessing if they’re going to be pinpointing and acquiring accounting program to do the lease accounting, or if they are going to use spreadsheet program.”

The new common is supplying corporations a new glance at their leases and the many hazards. “The silver lining is that the new specifications are giving businesses with the possibility to prioritize lease management to not only realize lease accounti

ng compliance, but also to make more robust business conclusions and superior control hazard,” Betesh mentioned in a assertion.

Some of the threats connected with not utilizing a right lease administration technique cited by the review include things like:

- An unnecessarily sophisticated lease accounting system that relies on handbook work

- A unsuccessful yearly audit owing to incomplete and inaccurate lease knowledge, potentially ensuing in elevated service fees, damaged trustworthiness and diminished credit score and,

- The incapability to pivot and deal with new business needs thanks to a absence of visibility into significant lease particulars.

The over-all regular and the various amendments from FASB introduce additional complexities. “There’s a great deal of nuances to the conventional and a good deal of schedules to preserve,” explained Winiarski. “For a lessee, you’ve obtained a plan to maintain for the liabilities as perfectly as the assets, and then the quantitative disclosures that summarize all of this. A large amount of companies are finding it less difficult to have a piece of program to observe that and to manage the modification accounting.”

Companies often want to produce new journal entries to keep track of the various lease modifications and tenant advancements.

“We’re discovering a good deal of shoppers that have a great deal of enhancements in their lease agreements and new agreements that are staying entered into,” explained Winiarski. “It appears like there’s been a great deal additional accounting where by lessees have been included in extra than the usual tenant advancements, so we’ve been evaluating whether or not a customer is included in construction and the accounting similar to that.”

By utilizing a centralized procedure, businesses have been automating the course of action and decreasing some of the challenges, but many firms are still trying to get their arms all over all the improvements.

“Companies are even now figuring out how significantly time it is using to implement the new standard,” said Winiarski. “As they’re finding into the venture, assessing the program and how a lot of leases they have, there’s continue to some shock about how lengthy it’s having to go through the total implementation and adoption of the regular.”

Embedded leases can be hidden in just contracts and will need to be accounted for effectively. “One of the merchandise that firms are on the lookout at is hoping to make confident they have the full inhabitants of their leases, so if they’ve bought a support agreement, is there an embedded lease inside of it?” reported Winiarski. “If they’re getting a provider, and there’s a piece of gear they use to provide that company, is that equipment genuinely an embedded lease that needs to be accounted for with the new leasing regular?”

Accountants will want to use their experienced judgment to assistance their purchasers and businesses. “There are a ton of estimates and judgments in the normal that corporations have to do the job via and figure out the procedures all-around them,” mentioned Winiarski. “The discount amount can adjust the lease classification and is an essential input. It not only influences what the lease liability and the appropriate of use asset can be, but it also can effect what the lease classification is, which impacts the profits statement as properly. I’m enthusiastic to see companies performing on it now and just cannot wait right up until the stop of the 12 months.”

[ad_2]

Supply link