[ad_1]

busracavus/iStock via Getty Images

Shipping and power/renewable energy-related stocks made the top five gainers, with Bloom Energy taking the #1 tag this week; while trucking/logistics stocks decline was a main theme among the losers.

Meanwhile, the S&P 500 is dipping into bear market territory, and volatility levels in the S&P VIX Index (VIX) have risen 5.7%. Traders are telling BofA Securities that an additional 8% drop in the S&P 500 (SP500) (SPY) is a bullish scenario.

For the week ending May 20, The SPDR S&P 500 Trust ETF (SPY) was -3.01%, now in the red for seven weeks a row. YTD, the ETF is -17.97%. The Industrial Select Sector SPDR (XLI) was -3.61%, now in the red for two weeks straight. YTD, XLI is -15.19%.

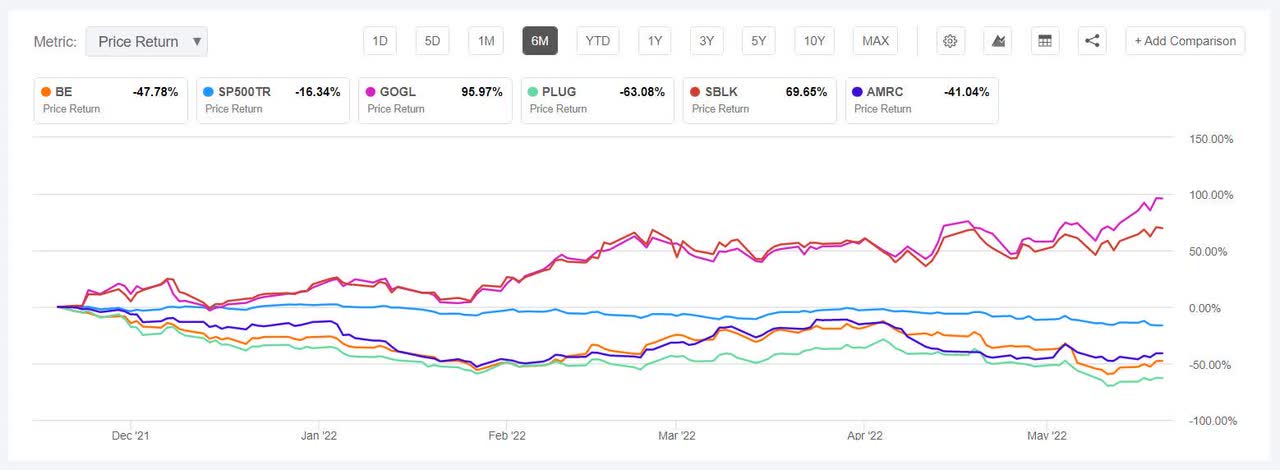

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +5% each.

Bloom Energy (NYSE:BE) +12.68%. The San Jose, Calif.-based company leapfrogged from the #1 decliner spot it found itself in two weeks ago to be top gainer this week. Bloom Energy, which provides power generation platform, gained the most on May 19 (+10.35%) after alternative energy stocks rallied following announcement of an EU plan to cut red tape for solar and winds installations in an effort to reduce reliance on Russian fossil fuels. However, YTD, the stock is still in the red and has declined -28.68%.

Golden Ocean (GOGL) +12.51%. The Bermuda-based shipping company’s stock rose at the start of the week then dipped and then again shot up on May 19 after reporting solid earnings and strong forecast for the quarters ahead. The company’s Q1 results also beat analysts’ estimates comfortably. About a month ago, Golden Ocean was among the top gainers of the week. Some Shipping stocks seem to be the silver lining amid the current market scenario. YTD, GOGL has risen +67.31. Check out: 3 Best Shipping Stocks To Buy Amid The Global Shipping Crisis.

The chart below shows 6-month price-return performance of the top five gainers and SP500TR:

Plug Power (PLUG) +9.45% jumped from the decliners’ list it was in last week following its earnings, to take a spot among the gainers. The company’s stock gained the most on May 17 (+9.83%) following news that it was awarded a 1 GW electrolyzer contract with H2 Energy Europe for a planned hydrogen production complex in Denmark. The stock again surged on May 19, as Bloom Energy did, following EU’s planned green push. However, YTD, PLUG, like BE, — both of which cater to the energy/power sector — is in the red -41.73%.

Star Bulk Carriers (SBLK) +7.20%. Similar to its peer Golden Ocean, this Greek shipping company gained this week and was also alongside GOGL among the gainers about a month ago. Star Bulk had also taken the #5 tag in 2021’s best five industrial stocks (in this segment), gaining +156.74%. YTD, SBLK has risen +41.29%, and along with GOGL is the only stock that is in the green YTD among this week’s top five gainers. The Wall Street Analysts’ Rating is Buy with an Average Price Target of $34.5.

Ameresco (AMRC) +5.64%. The Framingham, Mass.-based renewable energy solutions provider also gained the most on May 19 this week on the back of the EU announcement. YTD, AMRC has fallen -31.93%.

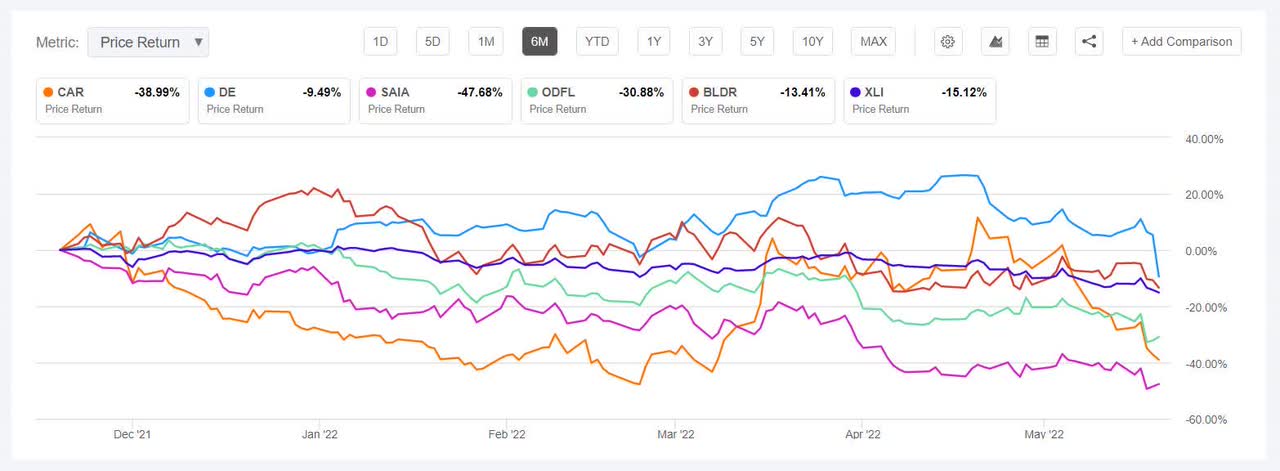

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -9% each. YTD, all these five stocks are in the red.

Avis Budget (NASDAQ:CAR) -14.84%. 2021’s best industrial stock +455.95% (in this segment) continued its decline for the second week in a row, after landing among the losers a week ago. The car/truck rental company’s shares declined the most on May 18 (-12.49%). The stock saw better days back in March and April, but YTD it has declined -15.76%. The Wall Street Analysts’ Rating is Hold with an Average Price Target of $247.

Deere (DE) -14.56%. The agriculture equipment provider’s shares fell sharply on May 20 (-14.07%) despite reporting a Q2 earnings beat. The stock fell to a 52-week low as supply chain pressures are expected to persist through year-end. YTD, DE is -8.63%.

The chart below shows 6-month price-return performance of the worst five decliners and XLI:

Trucking stocks fell on May 18, with the S&P 500 Trucking Index (SP500-20304020) declining ~11% and the Nasdaq Combined Transportation Index (TRAN) down over 5%.

Merchandise haulers Saia (SAIA) -12.79%, and Old Dominion Freight Line (ODFL) -10.96%, picked the third and fourth spot, respectively, in the decliners’ list this week. According to a report, trucking and logistics stocks fell amid weak outlook from retailers, including Target, which saw higher fuel and freight costs in Q1.

Saia stock fell to its lowest in over 29 months on Wednesday, amid Morgan Stanley cutting the company’s share price target to $190 from $204, implying potential downside of 8.4

%. Meanwhile, ODFL declined to its lowest in over 13 months, as Morgan Stanley cut the stock price target to $310 from $337, implying potential upside of 14%. YTD, SAIA is -44.35%, while ODFL -32.14%.

Builders FirstSource (BLDR) -9.07%. The Dallas-based building products maker wrapped up this week’s worst five decliners’ group. YTD, the stock has fallen -29.04% but the Wall Street Analysts’ Rating is Strong Buy with an Average Price Target of $97.21. Take look at this story from CEO Interviews: Is The Housing Bubble About To Burst? Builders FirstSource CEO Dave Flitman.

[ad_2]

Source link